Microsoft Accounting Software offers a range of solutions for businesses of all sizes, from small startups to large enterprises. These solutions boast powerful features designed to streamline financial management, improve accuracy, and boost overall efficiency. But what exactly makes Microsoft’s accounting software stand out, and is it the right fit for your business needs? Let’s dive in and explore the capabilities and benefits.

This comprehensive guide will unpack the various types of Microsoft accounting software, delve into their integration with other Microsoft products, analyze user experience, explore security features, and examine reporting and analytics capabilities. We’ll also touch upon scalability, customization options, and the robust customer support available. Real-world examples will illustrate how businesses are leveraging Microsoft’s accounting tools to achieve their financial goals.

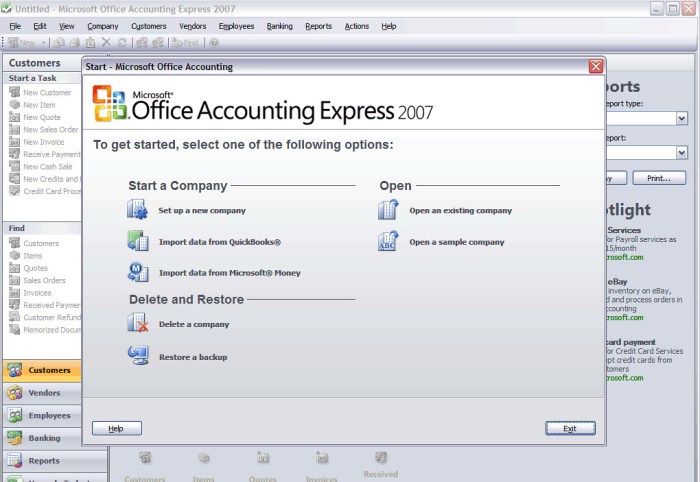

Overview of Microsoft Accounting Software

Microsoft offers a suite of accounting software solutions designed to cater to businesses of all sizes, from small startups to large enterprises. These solutions provide a range of features aimed at streamlining financial management, improving accuracy, and enhancing overall business efficiency. Understanding the differences between these offerings is crucial for choosing the right fit for your specific needs.

Microsoft’s accounting software options are designed to integrate seamlessly with other Microsoft products, fostering a cohesive and efficient workflow within your business ecosystem. This integration reduces data entry redundancy and minimizes the potential for human error, resulting in more reliable financial reporting and improved decision-making capabilities.

Microsoft Dynamics 365 Business Central

Microsoft Dynamics 365 Business Central is a comprehensive ERP (Enterprise Resource Planning) system that includes robust accounting functionalities. It’s ideal for mid-sized to large businesses requiring integrated financial management across multiple departments. Key features include financial management, supply chain management, project management, and customer relationship management (CRM). The software offers customizable dashboards and reporting tools, allowing businesses to tailor their financial insights to specific needs.

It also supports multiple currencies and languages, making it suitable for international businesses.

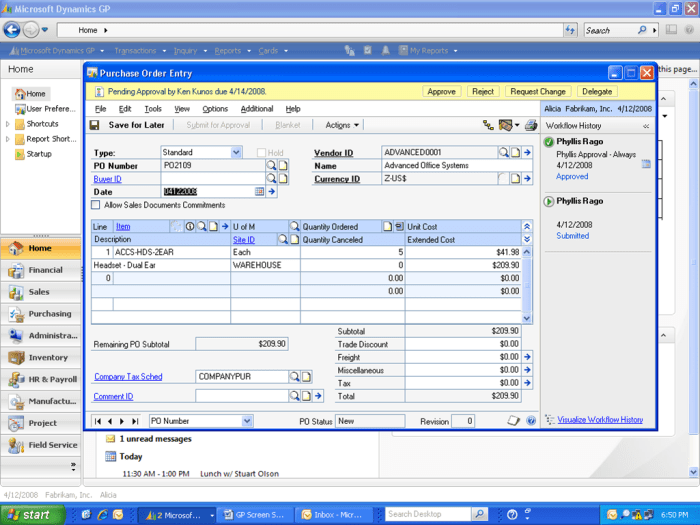

Microsoft Dynamics GP (Great Plains)

Historically a strong player in the accounting software market, Microsoft Dynamics GP (now largely phased out in favor of Business Central) is still used by some established businesses. It provides comprehensive accounting capabilities and integrates well with other Microsoft products. While it offers similar functionalities to Business Central, it lacks the scalability and modern interface of its successor. Businesses currently using Dynamics GP may find upgrading to Business Central advantageous for long-term growth and efficiency.

Microsoft Excel and Third-Party Add-ins

For smaller businesses with simpler accounting needs, Microsoft Excel, combined with third-party accounting add-ins, can provide a cost-effective solution. While not a dedicated accounting software, Excel’s spreadsheet capabilities, coupled with add-ins that provide accounting functionalities (like invoicing, expense tracking, and basic reporting), can suffice for basic financial management. However, this approach may require more manual input and lack the sophisticated features found in dedicated accounting software.

This option is best suited for businesses with minimal accounting complexity and a limited budget.

Comparison of Microsoft Accounting Software

The following table provides a comparison of pricing and key features for the different Microsoft accounting solutions. Note that pricing can vary significantly based on the number of users, modules selected, and specific implementation needs. Consult Microsoft or a certified partner for accurate pricing information.

| Software | Target Business Size | Pricing Tier (Approximate) | Key Features |

|---|---|---|---|

| Microsoft Dynamics 365 Business Central | Mid-sized to Large Enterprises | Subscription-based, varying by user and module | Comprehensive ERP system including financial management, CRM, supply chain, and project management. Advanced reporting and analytics. |

| Microsoft Dynamics GP | Mid-sized Businesses (legacy system) | One-time purchase or subscription (limited availability) | Comprehensive accounting and financial management capabilities. Integration with other Microsoft products. |

| Microsoft Excel with Add-ins | Small Businesses | Cost of Excel license + add-in cost (variable) | Basic accounting functionalities through add-ins. Limited scalability and automation. |

Integration with Other Microsoft Products

Microsoft accounting software isn’t just a standalone solution; it’s designed to seamlessly integrate with other Microsoft applications, boosting efficiency and streamlining your business operations. This interconnectedness minimizes data entry duplication, reduces errors, and allows for a more holistic view of your finances. Imagine a world where your accounting data effortlessly flows between your accounting software, spreadsheets, email, and team communication platforms – that’s the power of Microsoft’s integrated ecosystem.This integration fosters a more efficient and less error-prone workflow.

Data is automatically synchronized across platforms, eliminating the need for manual data entry and reducing the risk of human error. This also improves collaboration within your team, as everyone works with the same, up-to-date information. Let’s explore how this works in practice.

Integration with Microsoft Excel

Microsoft accounting software allows for effortless export of financial data to Excel. This enables detailed analysis, customized reporting, and the creation of insightful dashboards. For instance, you could easily export sales data to create charts visualizing sales trends over time, identifying peak seasons and informing strategic decisions. The data remains dynamic; updates in your accounting software are reflected in your Excel spreadsheets, ensuring your analyses are always based on the latest information.

This eliminates the tedious task of manually transferring data and reduces the risk of inconsistencies.

Integration with Microsoft Outlook

Seamless integration with Outlook streamlines invoice management and communication with clients. You can directly email invoices from within the accounting software, using pre-designed templates for a professional touch. Payment reminders can be automated, and all communication related to a specific invoice is neatly stored within the associated record. This centralized approach improves organization and makes tracking payments significantly easier.

For example, imagine automatically generating a follow-up email to clients with overdue invoices – saving valuable time and improving cash flow.

Integration with Microsoft Teams

Microsoft Teams facilitates real-time collaboration on accounting tasks. Teams allows for sharing financial reports, discussing accounting issues, and collaborating on projects, all within a centralized communication hub. This reduces the need for lengthy email chains or in-person meetings, fostering faster decision-making. For example, a team can use Teams to discuss a budget proposal, share relevant financial data from the accounting software, and make adjustments in real-time.

This streamlined process ensures everyone is on the same page and reduces delays in critical financial planning.

Workflow Diagram: Data Flow Between Microsoft Accounting Software and Other Microsoft Products

Imagine a diagram showing the flow of data. The central element is the Microsoft accounting software database. Arrows emanate from it, pointing to icons representing Excel, Outlook, and Teams. Another set of arrows points back to the accounting software database, illustrating the two-way flow of information. For example, an arrow from the accounting software to Excel shows the export of sales data for analysis.

Another arrow shows the import of updated budget figures from Excel back into the accounting software. Similar arrows would illustrate the sending of invoices from the accounting software to Outlook, and the use of Teams for collaborative discussions around financial reports generated from the accounting software. This visual representation highlights the dynamic exchange of information between the different applications, demonstrating the power of integrated workflow.

User Experience and Interface

Microsoft Accounting software aims for a user-friendly experience, regardless of the user’s accounting expertise. The interface is designed to be intuitive, minimizing the learning curve for both novice and experienced users. However, the effectiveness of this design depends on various factors, including the user’s prior experience with similar software and their comfort level with technology in general.The software’s interface incorporates a familiar ribbon-style menu, similar to other Microsoft Office applications, promoting ease of navigation.

This consistent design element allows users already familiar with Microsoft products to quickly adapt to the accounting software. The layout is generally clean and uncluttered, prioritizing essential functions while providing access to more advanced features through easily accessible menus and drop-down options. Data entry is streamlined, using clear and concise fields, minimizing the potential for errors. The software also provides helpful prompts and error messages to guide users through the process.

Potential User Challenges and Solutions

While Microsoft Accounting software strives for user-friendliness, users may still encounter challenges. Understanding these potential hurdles and offering proactive solutions is crucial for a positive user experience. For instance, users unfamiliar with accounting principles might struggle with understanding the terminology or correctly classifying transactions. To address this, the software could incorporate more detailed explanations and examples within the application itself, potentially including interactive tutorials or contextual help.

Another potential challenge is the initial setup and configuration of the software, which can be complex for less tech-savvy users. Microsoft could offer more comprehensive, step-by-step setup guides, perhaps incorporating video tutorials to visually demonstrate the process. Finally, users may encounter difficulty navigating complex financial reports or customizing them to their specific needs. Providing customizable report templates and improved filtering options could significantly alleviate this issue.

Generating a Financial Report: A Step-by-Step Guide

Generating financial reports is a core function of accounting software. The following steps illustrate how to create a simple profit and loss statement within the Microsoft Accounting software, assuming basic data entry has already been completed.

- Navigate to the Reporting Section: Locate and select the “Reports” tab within the software’s main interface. This tab typically houses all reporting functionalities.

- Select Report Type: From the available report options, choose “Profit and Loss Statement.” The software might offer various sub-categories or customization options within this report type.

- Specify Date Range: Define the period for which you want to generate the report. This is typically done by selecting a start and end date. The accuracy of the report heavily relies on the correctness of this selection.

- Customize Report (Optional): Depending on the software’s features, you might be able to customize the report by selecting specific accounts to include or exclude, changing the level of detail, or altering the report’s format.

- Generate and Review: Once the parameters are set, click the “Generate Report” button. The software will process the data and display the profit and loss statement. Carefully review the report for accuracy and completeness.

- Save or Export: Save the generated report to your computer for future reference or export it to other formats, such as PDF or Excel, for easier sharing or integration with other applications. This ensures easy accessibility and potential use in other documents.

Security and Data Protection

Protecting your financial data is paramount, and Microsoft accounting software understands this. Robust security measures are built-in to safeguard sensitive information from unauthorized access and potential breaches. This section will delve into the specific security features offered and how they compare to competitors, while also offering practical tips for users to further bolster their data protection.Microsoft accounting software employs a multi-layered security approach.

This includes encryption both in transit and at rest, protecting data as it travels across networks and while stored on servers or local devices. Access controls, using role-based permissions, allow administrators to finely tune user privileges, ensuring only authorized personnel can access specific data or perform particular actions. Regular security updates address vulnerabilities and patch security holes as they are discovered, a crucial aspect of maintaining a secure environment.

Furthermore, features like multi-factor authentication (MFA) add an extra layer of protection, requiring users to verify their identity through multiple methods before gaining access.

Security Feature Comparison

A direct comparison between Microsoft’s accounting software and its competitors requires specifying the particular competing software. However, generally speaking, Microsoft’s security features are on par with, and in some areas surpass, industry standards. Many competitors offer similar encryption and access control mechanisms. The key differentiator often lies in the integration with other Microsoft security products and services. For instance, the seamless integration with Azure Active Directory allows for centralized identity management and enhanced security policies across multiple applications, a feature not always readily available with other accounting software solutions.

This integration offers a holistic approach to security, providing a unified and strengthened security posture.

Best Practices for Enhanced Data Security

Maintaining the security of your financial data requires a proactive approach from users. The following best practices can significantly reduce the risk of breaches and data loss:

- Strong Passwords and Password Management: Utilize complex, unique passwords for all user accounts, and consider using a password manager to securely store and manage these credentials.

- Regular Software Updates: Keep the accounting software and operating system updated with the latest security patches to address known vulnerabilities.

- Multi-Factor Authentication (MFA): Enable MFA whenever possible to add an extra layer of security to user accounts.

- Access Control Management: Regularly review and adjust user permissions to ensure that only authorized personnel have access to sensitive information. The principle of least privilege should be applied – granting only the minimum necessary access rights to each user.

- Data Backups: Implement a robust data backup strategy, including both on-site and off-site backups, to protect against data loss due to hardware failure, malware, or other unforeseen events. Regular testing of backup and restore procedures is crucial.

- Security Awareness Training: Educate all users about common security threats, such as phishing scams and malware, and train them on safe computing practices.

- Regular Security Audits: Conduct periodic security audits to identify and address potential vulnerabilities in the system and user practices.

Reporting and Analytics Capabilities

Microsoft accounting software offers robust reporting and analytics capabilities, providing business owners with valuable insights into their financial performance. These tools go beyond simple balance sheets and income statements, offering a deeper understanding of key metrics and trends that can inform strategic decision-making. By leveraging these features, businesses can improve efficiency, identify areas for growth, and ultimately enhance profitability.Understanding the data presented in these reports is crucial for making informed business decisions.

The software’s reporting functionality allows for a comprehensive view of various aspects of the business, from cash flow and profitability to inventory management and customer analysis. This information can be used to track progress toward goals, identify potential problems, and make necessary adjustments to business strategies.

Types of Reports Generated

Microsoft accounting software generates a wide array of reports tailored to different business needs. These reports provide a detailed overview of various financial aspects, facilitating informed decisions and effective management. The types of reports available typically include, but are not limited to, balance sheets, income statements, cash flow statements, accounts receivable and payable reports, inventory reports, and sales reports.

More specialized reports can also be generated depending on the specific software version and add-ons. For example, some versions may offer reports on profitability by product line or customer segmentation analysis.

Using Reports for Business Decision-Making

The reports generated by the software serve as a foundation for strategic decision-making. For instance, a consistently negative cash flow statement might indicate the need for improved expense management or more efficient collection of receivables. A detailed sales report, broken down by product or customer segment, could highlight best-selling items or identify underperforming products requiring adjustments in marketing strategy or pricing.

Analyzing inventory reports can help businesses optimize stock levels, minimizing storage costs and avoiding stockouts or overstocking. By consistently monitoring these reports, businesses can proactively address potential issues and capitalize on opportunities for growth.

Customizing Reports to Meet Specific Business Needs

The ability to customize reports is a key strength of Microsoft accounting software. This ensures that the information presented is precisely tailored to the specific needs of the business.

- Report Filters: Most reports allow for filtering data based on various criteria such as date range, customer, product, or account. For example, a business might generate a sales report filtered by a specific month to analyze performance during that period, or filter by a particular customer to assess their contribution to overall revenue.

- Report Sorting: The ability to sort report data by various fields (e.g., sales amount, customer name, date) helps to quickly identify key trends and outliers. For instance, sorting a sales report by sales amount in descending order will immediately highlight the top-performing products or customers.

- Report Grouping: Grouping data by different categories (e.g., product category, sales region) provides a more granular view of performance. This allows for more focused analysis and identification of areas requiring attention. A business could group its sales report by product category to identify which categories are driving the most revenue.

- Report Columns: Many reports allow for the selection of specific columns to be included. This allows users to focus on the most relevant data for their analysis, improving clarity and efficiency. For example, a business might choose to include only the total sales amount and the quantity sold in a sales report, rather than including every single line item.

By effectively utilizing these customization options, businesses can create reports that provide the precise information needed to support their decision-making processes, resulting in improved operational efficiency and strategic planning.

Scalability and Customization: Microsoft Accounting Software

Microsoft’s accounting software solutions offer a range of options designed to grow with your business, adapting to changing needs and increasing complexity. Whether you’re a small startup or a rapidly expanding enterprise, there’s a level of scalability and customization to match your requirements. The software’s adaptability is a key factor in its longevity and widespread adoption across various business sectors.The software’s scalability is achieved through several mechanisms.

For instance, database capacity can be increased to handle larger volumes of transactions and data as your business grows. Furthermore, many versions allow for the addition of user licenses, enabling more employees to access and utilize the system concurrently. Customization options allow businesses to tailor the software to their specific workflows and reporting needs, maximizing efficiency and integration with existing systems.

This adaptability is crucial for businesses that anticipate significant growth or foresee evolving accounting practices.

Customization Options Across Different Versions, Microsoft accounting software

Microsoft’s accounting software offerings cater to different business sizes and complexities. The extent of customization available varies across these versions, influencing the overall user experience and functionality. The table below highlights some key differences in customization options:

| Feature | Microsoft Dynamics 365 Business Central | Microsoft Dynamics GP | Smaller Business Solutions (e.g., QuickBooks Online) |

|---|---|---|---|

| Customizable Dashboards and Reports | Extensive customization through built-in tools and extensions; allows for creation of highly tailored dashboards and reports to visualize key metrics. | Significant customization capabilities, allowing users to create and modify reports to meet specific reporting requirements. | Limited customization, primarily through pre-built templates and limited report modification options. |

| Workflow Automation | Robust workflow automation capabilities enabling customization of approval processes, data entry workflows, and other business processes. | Supports workflow automation through customization and integration with other systems. Flexibility varies depending on specific modules and configurations. | Basic workflow capabilities; often relies on third-party integrations for more advanced automation. |

| Integration with Third-Party Apps | Extensive API support allowing seamless integration with a wide range of third-party applications, enhancing functionality and data exchange. | Offers integration capabilities, though the extent of customization and ease of integration can vary depending on the third-party application. | Limited integration options, often restricted to applications specifically designed for compatibility. |

| API Access and Extensibility | Provides comprehensive API access for developers to build custom solutions and integrate with other systems. This allows for highly tailored solutions. | Offers API access, but the level of extensibility might be less extensive compared to Business Central. | Limited or no API access, restricting the development of highly customized solutions. |

Customer Support and Resources

Navigating the world of accounting software can sometimes feel like deciphering a complex financial code. Fortunately, Microsoft offers a robust support system to help users of its accounting software overcome challenges and maximize their software’s potential. Whether you’re a seasoned accountant or a small business owner just starting out, understanding the available resources is key to a smooth and efficient experience.Microsoft provides multiple avenues for accessing assistance and learning resources.

This ensures users can find the help they need, regardless of their technical proficiency or the nature of their query. A multi-faceted approach, encompassing various support channels and self-service options, is crucial for effective user support.

Customer Support Options

Microsoft offers a range of customer support options designed to cater to diverse user needs. These options provide various levels of assistance, from readily available self-service resources to direct interaction with support specialists. This comprehensive approach ensures that users can quickly find solutions to their problems. Options typically include online help articles, community forums, phone support, and email support.

The availability and specifics of these options may vary depending on the specific Microsoft accounting software product and licensing agreement. For example, some premium subscriptions might include priority phone support and dedicated account managers.

Online Resources and Tutorials

Microsoft’s website is a treasure trove of helpful resources for users of its accounting software. The website features extensive documentation, including user manuals, troubleshooting guides, and frequently asked questions (FAQs). Many Microsoft products also have dedicated online communities where users can interact, share tips, and seek assistance from peers and Microsoft experts. In addition, Microsoft regularly publishes tutorials and video guides demonstrating various software functionalities and best practices.

These resources provide step-by-step instructions, making complex tasks more manageable. For instance, a video tutorial might guide users through the process of setting up a new chart of accounts or generating a customized financial report. The Microsoft Learn platform also offers structured learning paths covering various aspects of the software, ensuring users can build their skills at their own pace.

Frequently Asked Questions (FAQs)

Understanding common user queries and their solutions can significantly reduce the need for direct support interactions. Below are some frequently asked questions regarding Microsoft accounting software, along with their corresponding answers:

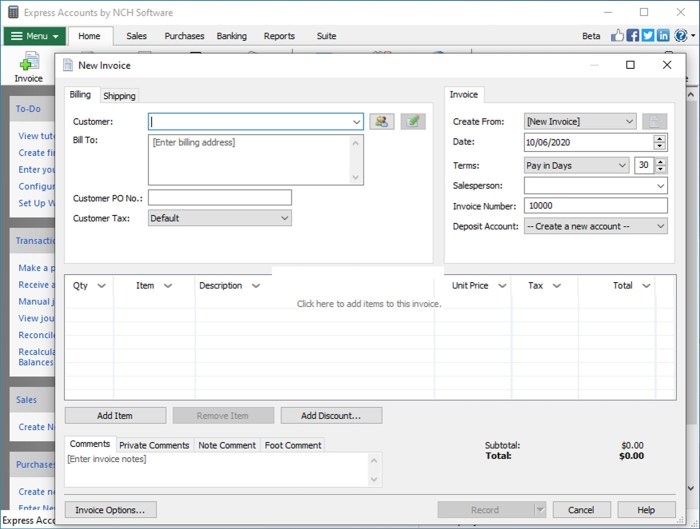

- Q: How do I create a new invoice? A: The process typically involves navigating to the “Invoices” section, entering customer details, adding line items, and selecting payment terms. Detailed instructions can be found in the software’s user manual or online help section.

- Q: What reports can I generate with the software? A: The software typically supports a wide array of reports, including profit and loss statements, balance sheets, cash flow statements, and customized reports tailored to specific business needs. The specific reports available might vary depending on the software version and licensing.

- Q: How do I back up my data? A: Regular data backups are crucial. The software often provides built-in backup functionality, allowing users to schedule automatic backups or perform manual backups to a local or cloud storage location. The exact process might vary based on the software version.

- Q: What security measures are in place to protect my data? A: Microsoft employs various security measures, including encryption, access controls, and regular security updates, to protect user data. Specific security features might vary depending on the software version and the user’s subscription level.

Case Studies

Microsoft accounting software finds application across diverse business landscapes, proving its adaptability and scalability. Examining real-world examples reveals the software’s strengths and weaknesses, offering valuable insights for potential users. The following case studies illustrate how businesses of varying sizes and industries leverage the software’s capabilities.

Small Retail Business: “The Cozy Corner Bookstore”

“Microsoft accounting software has been a lifesaver for our small bookstore. The inventory management features are incredibly helpful, and the reporting tools give us a clear picture of our sales trends. We’ve been able to make better decisions about ordering and pricing thanks to the data insights.”

Sarah Miller, Owner, The Cozy Corner Bookstore

The Cozy Corner Bookstore, a small independent bookstore with five employees, uses Microsoft accounting software primarily for inventory management, sales tracking, and financial reporting. The ease of use and integration with their point-of-sale system were key factors in their decision to adopt the software. They experienced a significant improvement in their inventory accuracy and a reduction in manual data entry.

However, they initially faced challenges integrating the software with their existing email marketing system, requiring some technical assistance.

Medium-Sized Manufacturing Company: “Precision Parts Inc.”

“The scalability of Microsoft accounting software has been essential to our growth. As we’ve expanded, the software has been able to adapt to our increasing needs, providing us with the tools we need to manage our complex financial operations effectively.”

David Lee, CFO, Precision Parts Inc.

Precision Parts Inc., a medium-sized manufacturing company with 50 employees, utilizes Microsoft accounting software for comprehensive financial management, including accounts payable and receivable, budgeting, and project cost tracking. The software’s ability to handle multiple projects simultaneously and generate detailed financial reports proved highly beneficial. The company faced initial challenges in training their staff on the more advanced features of the software, requiring dedicated training sessions.

The benefits, however, significantly outweighed the costs of implementation and training.

Large Multinational Corporation: “GlobalTech Solutions”

“The robust security features and multi-currency capabilities of Microsoft accounting software are crucial for our global operations. The software allows us to maintain a consistent financial reporting standard across all our subsidiaries, ensuring regulatory compliance and efficient financial management.”

Maria Garcia, Head of Finance, GlobalTech Solutions

GlobalTech Solutions, a large multinational corporation with over 1000 employees across multiple countries, uses Microsoft accounting software for its consolidated financial reporting and multi-currency transactions. The software’s ability to handle complex accounting standards and integrate with various financial systems worldwide was a significant factor in its selection. The company experienced some challenges in customizing the software to meet the specific regulatory requirements of different countries, but the overall benefits of a unified financial system outweighed these hurdles.

The ability to track finances across numerous subsidiaries in various currencies is paramount to their success.