Measuring the ROI of business intelligence investments in a company is crucial for justifying expenditures and ensuring optimal resource allocation. This isn’t just about crunching numbers; it’s about understanding how data-driven insights translate into tangible business growth. We’ll explore how to define BI ROI, identify measurable benefits, quantify associated costs, and develop a robust framework for tracking progress.

Get ready to unlock the true potential of your BI investments!

From defining key performance indicators (KPIs) and establishing baselines to navigating the complexities of cost allocation and addressing potential biases, this guide provides a comprehensive roadmap for accurately measuring the return on your business intelligence initiatives. We’ll delve into real-world case studies, highlighting both successful and less successful implementations, offering valuable lessons learned along the way. Prepare to transform your data into actionable strategies!

Defining Business Intelligence (BI) ROI

Calculating the return on investment (ROI) for Business Intelligence (BI) initiatives isn’t always straightforward. Unlike tangible assets, the value of BI often lies in improved decision-making, leading to indirect financial benefits. A comprehensive approach is crucial to accurately assess its impact.BI ROI encompasses the quantifiable gains resulting from better data-driven decisions, contrasted against the total investment in the BI system, including software, hardware, implementation, training, and ongoing maintenance.

It’s not simply about the cost of the software; it’s about the overall impact on the business’s bottom line.

Components of a Comprehensive BI ROI Calculation

A complete BI ROI calculation requires considering both the costs and the benefits. Costs include the initial investment in software and hardware, ongoing maintenance fees, employee training, and consulting expenses. Benefits, on the other hand, are more multifaceted and require careful measurement. They encompass improved operational efficiency, reduced costs, increased revenue, and enhanced customer satisfaction. The challenge lies in accurately quantifying these intangible benefits.

Key Performance Indicators (KPIs) Linked to BI Investments

Several KPIs directly reflect the impact of BI investments. These metrics provide a clear picture of the return on investment.

| KPI | Measurement Method | Target Value | Data Source |

|---|---|---|---|

| Increased Sales Revenue | Compare sales figures before and after BI implementation | 15% increase year-over-year | Sales CRM, Financial Reporting System |

| Reduced Operational Costs | Analyze cost savings in areas like inventory management, supply chain optimization, or marketing spend | 10% reduction in operational expenses | ERP System, Expense Reports, Inventory Management System |

| Improved Customer Retention Rate | Track customer churn before and after BI implementation | 5% increase in customer retention | CRM System, Customer Support Ticketing System |

| Faster Time to Market | Measure the time taken to launch new products or services | 20% reduction in time to market | Project Management Software, Product Development Tracking System |

| Enhanced Employee Productivity | Assess employee efficiency and output based on key tasks | 10% increase in employee productivity | HR System, Performance Management System |

Hypothetical Scenario: BI Driving Tangible Financial Gains

Imagine a retail company struggling with inefficient inventory management. High stock levels lead to storage costs and potential losses due to obsolescence. By implementing a BI system with advanced analytics, the company gains real-time visibility into inventory levels, sales trends, and customer demand. This allows for optimized ordering, reducing excess inventory by 20%. If the company’s average inventory holding cost is $100,000 per month, this translates to a monthly saving of $20,000, or $240,000 annually.

This represents a significant return on the BI investment.

Identifying Measurable Benefits of BI Implementation

Unlocking the true value of Business Intelligence (BI) investments hinges on effectively identifying and quantifying its benefits. While the immediate cost of implementation is clear, the long-term gains often require a more nuanced approach. This involves translating qualitative improvements into concrete, measurable metrics that directly contribute to the ROI calculation.Transforming Qualitative Benefits into Quantifiable Metrics for ROIMany BI benefits are initially perceived as qualitative – improved decision-making, enhanced customer satisfaction, or increased operational efficiency.

However, these can be translated into hard numbers. For instance, improved decision-making can be measured by comparing the success rate of decisions made

- before* and

- after* BI implementation. Similarly, enhanced customer satisfaction can be quantified through changes in customer churn rates or Net Promoter Scores (NPS). Increased operational efficiency might be reflected in reduced production costs or faster turnaround times. The key is to define specific, measurable, achievable, relevant, and time-bound (SMART) goals

- before* BI implementation and then track progress against those goals.

Quantifying BI ROI Across Industries

The ROI of BI varies significantly across different industries due to varying operational structures, data complexities, and competitive landscapes. Consider these examples:In the retail industry, a company might use BI to optimize inventory management, reducing stockouts and overstocking. This directly impacts profit margins, with quantifiable improvements in inventory turnover and reduced storage costs. A successful implementation could easily yield a 20-30% ROI within two years.Within the healthcare sector, BI can streamline patient care, leading to reduced hospital readmission rates.

A 10% reduction in readmissions translates into significant cost savings and improved patient outcomes, easily justifying the initial BI investment. ROI can be calculated by comparing the cost savings from reduced readmissions against the BI implementation cost.The manufacturing industry benefits from predictive maintenance, enabled by BI’s analysis of equipment performance data. This reduces downtime and repair costs, leading to increased productivity and higher output.

A 15% reduction in downtime can represent substantial cost savings and a strong positive ROI.

Establishing a Baseline for Measuring BI Impact

Before implementing BI, it’s crucial to establish a baseline to accurately measure its impact. This involves gathering data on key performance indicators (KPIs)before* the BI system is deployed. This baseline provides a benchmark against which to compare performance after the BI system is operational. This baseline data might include sales figures, customer acquisition costs, marketing campaign effectiveness, operational costs, and production efficiency metrics.

The difference between the post-implementation performance and the baseline provides a quantifiable measure of the BI system’s contribution.

Determining the ROI of business intelligence investments can be tricky, but a key factor is how effectively your data systems are integrated. A robust system, like a well-implemented sistem erp , provides the centralized data needed for accurate analysis and reporting, directly impacting your ability to measure the true return on your BI investment. Ultimately, efficient data management is crucial for a clear picture of your BI ROI.

BI’s Contribution to Improved Departmental Efficiency

A well-implemented BI system significantly improves efficiency across various departments.

- Sales: Improved sales forecasting, leading to better inventory management and optimized sales strategies, resulting in increased revenue and reduced lost sales.

- Marketing: Data-driven insights into customer behavior enable targeted campaigns, improved customer segmentation, and increased marketing ROI, leading to higher conversion rates and customer lifetime value.

- Operations: Streamlined processes, optimized resource allocation, and predictive maintenance reduce operational costs, improve production efficiency, and minimize downtime.

- Finance: Enhanced financial reporting, improved forecasting accuracy, and better risk management leading to more informed financial decisions and reduced financial risks.

- Human Resources: Data-driven insights into employee performance, talent acquisition, and retention strategies leading to improved employee satisfaction and reduced turnover.

Quantifying Costs Associated with BI Initiatives: Measuring The ROI Of Business Intelligence Investments In A Company

Accurately measuring the ROI of a Business Intelligence (BI) system requires a thorough understanding of all associated costs. Ignoring even seemingly minor expenses can skew the final ROI calculation, leading to inaccurate conclusions about the investment’s effectiveness. This section focuses on identifying and categorizing these costs, highlighting the challenges in accurate cost allocation, and offering strategies for more precise ROI determination.

Direct and Indirect Costs of BI Implementation

Implementing and maintaining a BI system involves a range of costs, both directly attributable to the system and indirectly impacting its operation. A comprehensive cost analysis must account for both to achieve an accurate ROI figure. Failing to do so will inevitably lead to an underestimation or overestimation of the true investment. This can lead to incorrect business decisions regarding the BI system’s future.

| Cost Category | Description | Example | Estimated Cost Range (USD) |

|---|---|---|---|

| Software Licenses | Costs associated with purchasing or subscribing to BI software, data visualization tools, and related applications. | License fees for Tableau, Power BI, or Qlik Sense. | $1,000 – $100,000+ per year, depending on the number of users and features. |

| Hardware | Costs related to purchasing or leasing servers, storage devices, and other hardware necessary to support the BI system. This may include cloud infrastructure costs. | Servers, data storage arrays, network infrastructure. Cloud services from AWS, Azure, or Google Cloud. | $5,000 – $500,000+ depending on infrastructure scale and chosen platform. |

| Personnel | Salaries and benefits for employees involved in the BI system’s implementation, maintenance, and use. This includes data analysts, data engineers, BI developers, and IT support staff. | Salaries for data analysts, database administrators, and BI developers. | $100,000 – $1,000,000+ per year depending on team size and expertise. |

| Training | Costs associated with training employees to use and effectively leverage the BI system. | Internal training programs, external consulting, software vendor training. | $1,000 – $50,000+ depending on the number of employees and training intensity. |

| Data Integration and Cleansing | Costs associated with preparing and cleaning data for use in the BI system. This often involves significant time and resources to ensure data quality. | Hiring data engineers, using ETL (Extract, Transform, Load) tools, data quality assessments. | $5,000 – $100,000+ depending on data volume and complexity. |

| Maintenance and Support | Ongoing costs for system maintenance, software updates, technical support, and bug fixes. | Software maintenance contracts, IT support staff time, system upgrades. | $5,000 – $50,000+ per year depending on system complexity and support level. |

Challenges in Assigning Costs to BI Improvements

Accurately attributing specific cost improvements to the BI system is a significant challenge. Many BI-driven improvements are indirect and difficult to quantify in monetary terms. For example, improved decision-making may lead to increased efficiency, but directly linking that efficiency gain to the specific cost of the BI system is complex. Similarly, preventing a potential loss (e.g., avoiding a costly mistake) is difficult to quantify financially.

Effective Cost Allocation for Accurate ROI Calculation

To overcome the challenges of cost allocation, a phased approach is recommended. First, meticulously document all direct costs. Then, for indirect costs, use a combination of methods, such as time tracking for personnel involved in BI-related tasks, surveys to gauge employee perceptions of time saved, and comparisons of key performance indicators (KPIs) before and after BI implementation. A weighted average approach can be used to allocate indirect costs proportionally to the different benefits achieved.

For example, if improved decision-making contributes 60% to the overall benefit and reduced operational costs contribute 40%, the indirect costs should be allocated accordingly. This approach requires careful planning and data collection but allows for a more realistic ROI calculation.

Developing a Framework for Measuring BI ROI

Measuring the return on investment (ROI) for Business Intelligence (BI) initiatives isn’t always straightforward. Unlike tangible assets, the value of BI often manifests in improved decision-making, operational efficiency, and increased revenue streams – all requiring careful measurement and analysis. A robust framework is essential to accurately track and demonstrate the value of your BI investments.

A Step-by-Step Process for Calculating BI ROI

Calculating the ROI of BI investments requires a systematic approach. This involves defining key performance indicators (KPIs), collecting relevant data, and applying appropriate calculation models. The process begins with clearly defining the objectives of your BI implementation. What specific business problems are you hoping to solve? What improvements are you aiming for?

These objectives will dictate the KPIs you track and the data you collect. Subsequently, you’ll need to establish a baseline to compare your performance before and after BI implementation. This baseline will provide a benchmark against which to measure the improvements driven by your BI initiatives. Data collection involves gathering information from various sources, including databases, CRM systems, and other relevant platforms.

Data analysis involves identifying trends, patterns, and insights that demonstrate the impact of your BI initiatives. Finally, you’ll apply a suitable ROI calculation model (discussed below) to quantify the return on your investment.

Examples of Different ROI Calculation Models

Several models can be used to calculate BI ROI, each suited to different scenarios and data availability.

- Simple ROI: This is the most basic model, calculating ROI as (Net Benefits – Total Costs) / Total Costs. For example, if a BI project costs $100,000 and generates $150,000 in additional revenue, the simple ROI is 50%.

- Discounted Cash Flow (DCF): This model accounts for the time value of money, considering the present value of future benefits. It’s particularly useful for long-term BI projects with ongoing benefits. For instance, a BI project might yield $20,000 annually for five years. The DCF model would calculate the present value of those future cash flows, factoring in a discount rate to reflect the risk and opportunity cost of capital.

- Return on Investment (ROI) based on Cost Savings: If the primary benefit of BI is cost reduction, the ROI is calculated as (Cost Savings – Total Costs) / Total Costs. For example, if a BI project costs $50,000 and results in $75,000 in annual cost savings, the ROI is 50%.

Choosing the right model depends on the specific goals and nature of your BI project. The simple ROI model is useful for quick estimations, while the DCF model provides a more comprehensive assessment for long-term projects. Focusing on cost savings is appropriate when BI is primarily used for efficiency improvements.

Best Practices for Tracking and Reporting on BI ROI Over Time

Consistent monitoring and reporting are crucial to demonstrate the ongoing value of BI investments. Establish clear KPIs and metrics from the outset. Regularly collect and analyze data to track progress against these metrics. Automate data collection and reporting whenever possible to streamline the process and ensure accuracy. Present findings in clear, concise reports using visualizations like charts and graphs to effectively communicate the ROI to stakeholders.

Regularly review and refine your ROI measurement framework based on feedback and evolving business needs. Consider using a dashboard to visually represent key metrics and their trends over time. This provides a clear and easily understandable overview of the BI project’s performance.

A Flowchart Illustrating the Process of Measuring and Reporting BI ROI

Imagine a flowchart starting with a “Define BI Objectives and KPIs” box, leading to “Establish Baseline Performance” and then “Implement BI Solution”. The next step would be “Collect Data from Various Sources,” followed by “Analyze Data and Identify Impacts.” This feeds into “Calculate ROI using Chosen Model,” which then leads to “Report Findings to Stakeholders.” Finally, a feedback loop connects “Report Findings to Stakeholders” back to “Define BI Objectives and KPIs,” signifying continuous improvement and refinement of the process.

The flowchart visually depicts the iterative nature of BI ROI measurement, highlighting the importance of ongoing monitoring and adjustment. Each box represents a distinct phase, and the arrows indicate the flow of the process. The overall structure is linear but cyclical, emphasizing the continuous nature of BI ROI evaluation.

Addressing Challenges in Measuring BI ROI

Measuring the return on investment (ROI) for Business Intelligence (BI) initiatives isn’t always straightforward. While the potential benefits are substantial, accurately quantifying them can be surprisingly complex, often requiring a move beyond simple financial metrics. This section explores the inherent challenges and proposes strategies for a more holistic and accurate assessment.Limitations of Traditional Financial Metrics in Capturing the Full Value of BI InvestmentsTraditional financial metrics, like return on assets (ROA) or return on equity (ROE), often fall short when evaluating BI investments.

These metrics primarily focus on easily quantifiable financial outcomes, overlooking the significant, albeit less tangible, benefits that BI systems often deliver. For example, improved decision-making, enhanced operational efficiency, and increased customer satisfaction are difficult to translate directly into a precise monetary value using these traditional methods. A company might see a significant reduction in operational costs due to improved inventory management facilitated by BI, but this improvement might not be fully reflected in a simple ROA calculation if other financial factors remain unchanged.

The true value lies in the broader impact on the business, which traditional metrics fail to capture completely.

Potential Biases Affecting the Accuracy of ROI Calculations

Several biases can skew ROI calculations, leading to inaccurate assessments of BI effectiveness. One common bias is the tendency to overestimate the benefits while underestimating the costs. This can stem from the enthusiasm surrounding a new technology or a lack of rigorous cost accounting for implementation, maintenance, and training. Conversely, attributing all positive outcomes solely to the BI system, without considering other contributing factors, represents another significant bias.

For instance, a rise in sales following BI implementation might be partially due to a successful marketing campaign, rather than solely attributable to the improved insights provided by the BI system. A robust ROI calculation needs to account for these confounding factors to avoid skewed results.

Strategies to Overcome Challenges and Ensure a More Comprehensive Assessment

Overcoming these challenges requires a multi-faceted approach. First, adopting a more holistic view that incorporates both tangible and intangible benefits is crucial. Second, meticulous cost accounting, including all associated expenses, from initial investment to ongoing maintenance, is essential. Third, employing a combination of quantitative and qualitative data, including surveys and feedback, can offer a more nuanced understanding of the BI system’s impact.

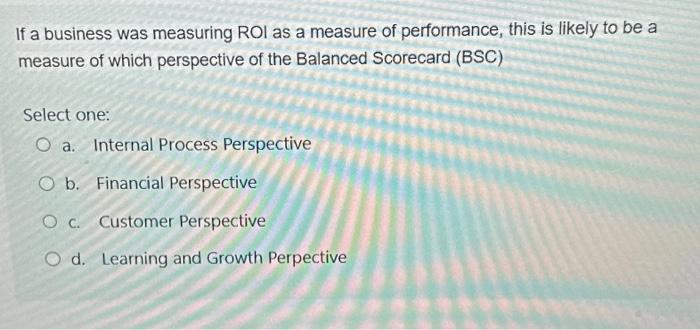

Finally, using a balanced scorecard approach, which considers perspectives beyond just financial performance, allows for a more complete evaluation of the BI investment’s value. This could include measures of customer satisfaction, employee productivity, and process efficiency.

Incorporating Intangible Benefits into the ROI Calculation

Incorporating intangible benefits, like improved customer satisfaction, requires creative approaches. One strategy is to quantify these benefits using proxy metrics. For example, improved customer satisfaction might be measured by increased customer retention rates, which can then be translated into a monetary value by estimating the cost of acquiring new customers. Similarly, enhanced employee productivity, resulting from improved data access and decision-making, could be quantified by measuring increases in output or reductions in error rates.

By assigning monetary values to these intangible benefits, they can be included in the overall ROI calculation, providing a more comprehensive picture of the investment’s value. For example, a company might estimate that improved customer satisfaction, as measured by increased customer lifetime value, adds X dollars to the bottom line, directly contributing to a more accurate ROI calculation.

Case Studies

Analyzing real-world examples provides crucial insights into the effectiveness of BI investments. Two contrasting case studies—one showcasing high ROI and the other a lower return—highlight the factors influencing success. Understanding these differences helps businesses make informed decisions about their own BI strategies.

High BI ROI Case Study: Retail Giant Optimizes Inventory Management

This multinational retail chain implemented a comprehensive BI system to improve inventory management. The system integrated data from various sources, including point-of-sale systems, warehouse databases, and supplier information. This allowed for real-time visibility into inventory levels, demand forecasting, and supply chain performance.

Low BI ROI Case Study: Manufacturing Company Struggles with Data Integration

A mid-sized manufacturing company invested in a BI system but struggled to achieve significant ROI. The company faced challenges integrating data from disparate legacy systems, resulting in inaccurate and incomplete data. Furthermore, a lack of skilled personnel to manage and interpret the data hampered the system’s effectiveness.

| High BI ROI: Retail Giant | Low BI ROI: Manufacturing Company |

|---|---|

| KPIs Used: Inventory turnover rate, stockout rate, order fulfillment time, sales growth, profit margin. | KPIs Used: Production efficiency, defect rate, machine downtime, customer satisfaction (partially captured). |

| Data Collection Methods: Real-time data feeds from POS systems, warehouse management systems, and supplier portals; automated data extraction and transformation processes. | Data Collection Methods: Manual data entry from various sources, inconsistent data formats, limited automation. |

| ROI Calculation: Increased sales due to reduced stockouts (15%), decreased inventory holding costs (10%), improved order fulfillment (5%). Total ROI calculated as a percentage increase in profit margin, resulting in a 25% return on investment within 18 months. | ROI Calculation: Minimal improvements in production efficiency (2%), higher costs associated with data integration challenges and consultant fees. The overall ROI was less than 5% after two years, barely exceeding the initial investment costs. |

Lessons Learned from Case Studies, Measuring the ROI of business intelligence investments in a company

The contrasting outcomes highlight the importance of meticulous planning, robust data integration, and skilled personnel in achieving a high BI ROI. The retail giant’s success stemmed from its proactive approach to data management and a clear understanding of its key performance indicators. Conversely, the manufacturing company’s failure underscores the critical need for addressing data integration challenges and investing in adequate training for personnel.

Investing in high-quality data infrastructure and skilled analysts is crucial for a successful BI implementation. A clear understanding of the business objectives and the selection of appropriate KPIs are also vital for measuring the impact of BI investments accurately.